Fully-optioned, customisable off-track motorsport insurance.

Concentrate on winning with our off-track motorsport insurance.

Motorsport insurance for enthusiasts and professionals.

We protect all your motorsport vehicles and assets.

Star Insurance Motorsport is the most comprehensive, customisable off-track insurance for motorsport individuals and teams. We don’t cover race cars on-track but the quality of our policy means you can concentrate on winning without the added fear of asset damage and loss.

Key reasons to insure with Star Insurance Motorsport

We protect your motorsport vehicles and assets.

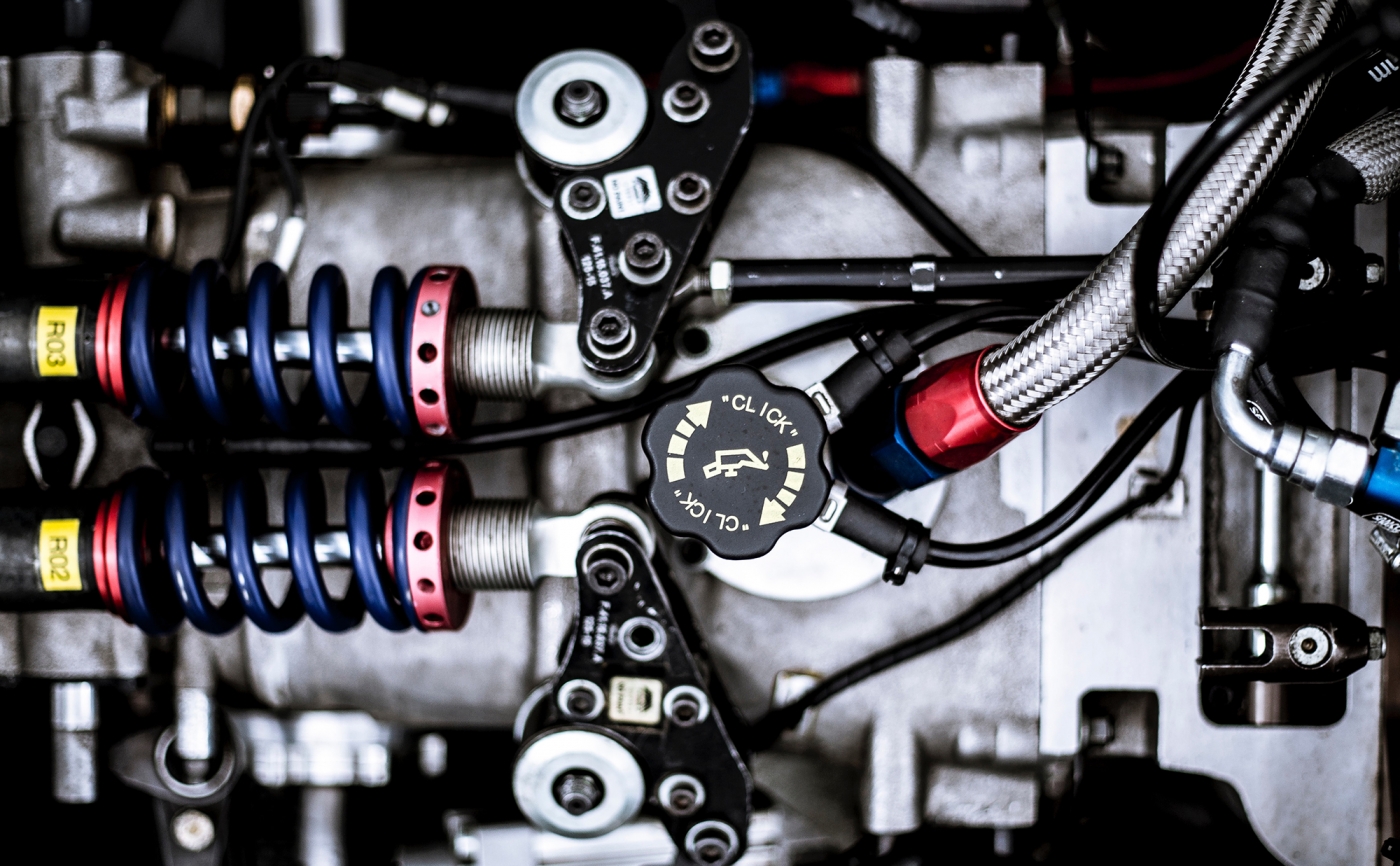

This policy was developed to protect the assets and vehicles of motorsport teams heading to and from events and when in storage and at events off-track. Policy benefits for your motorsport assets include:*

Certified value options available

Our insurance policy extends to automatically insure spare parts for the vehicle

Discounts and package premiums for vehicle collections

Insurance for vehicles undergoing restoration

Insurance for specialist vehicles, such as race cars, stock cars.

Options for road registered and unregistered vehicles

Options to buy wreck back in the event of a total loss.

*Terms and conditions apply. Not all benefits apply to all policies. Please refer to the policy booklet (and your schedule if issued) for further information or call us to discuss your specific needs.

We deliver motorsport teams the Star treatment

Star Insurance knows and loves motorsport

Your race car is protected until it hits the race track. All your other assets including spare parts, tools and trailer are protected to and from the track and everywhere else, all the time.

Motorsport is an exciting industry with many moving parts that lead up to track days and events. It’s a huge investment that requires the right kind of race car, the right team and effort to bring the car together, along with a lot of skill and some luck on the day to reach the podium. It can all be lost if you don’t have the right motorsport insurance.

Our motorsport insurance policy was created to cover:

loss and damage of competition vehicles and property including vehicle parts and accessories

tools and trailers whilst at their storage facilities and at home

assets being transported to and from a race meeting in New Zealand or worldwide

assets in storage at an event; and when outside your accommodation at track events

your vehicle while it is being built, repaired or prepared for race day at a workshop

Your vehicles and assets against theft and fire.

We presently cover: Race cars, Speedway cars, Stock cars, Drifting cars, Circuit cars, Rally cars, Open wheelers and more.

Frequently asked questions.

Sometimes you just want a simple answer. Here it is.

-

Yes, photos are very helpful as they can show our assessing team what has been damaged before the vehicle is seen by a repairer. Please obtain accident site photos only if it is safe to do so.

-

Upon application, we can extend terms to provide you cover for certain approved track days. Every track day and driver is subject to application, and are monitored and approved on a case by case basis.

-

If you’re under 25 give us a call to see if we can embrace you and your passion ride, because every vehicle we insure is based on our knowledge of the car, the market and the driver.

-

Roadside assistance is available as an optional extension to your policy.

Currently, this can be purchased for an additional $59.95

-

We are happy for you to take your vehicle to a repairer of your choice. If you need help finding a repairer, our assessors have a list of repairers we can suggest which are best suited for the type of vehicle you have.

-

Yes, we can. We can tailor the policy to your individual needs and ensure that you have the best cover in the market at the most cost-effective premium.

-

Yes, we offer a storage and restoration cover. Please refer to our Star Prestige, Enthusiast & Everyday policy wording and/or call one of our knowledgeable team to discuss.

-

In short, there are none.

We don’t restrict mileage on your policy as we rate vehicles on how they are used. We understand that some years you may do a big tour, where other years, your vehicle will hardly leave the garage. We don’t restrict kilometres but do ask that you give us an accurate picture of how you are using your vehicle.

What do I need to get a quote?

- Personal details

Obviously we need to collect some personal details about you, including your driver’s licence info, date of birth, address and more. This helps to paint an overall picture of your policy application.

- Vehicle and asset details

What vehicle and assets do you want insured? This information will let us see a lot more detail as we tap into the NZTA website. We’ll also ask how the vehicle is being used and how often.

- Your driving history

Have you started a collection of speeding tickets, had previous accidents, and/or any convictions? These are 3 of the 8 questions we’ll ask you as part of this process. Insurance is based on good faith, which is why it’s important to make honest statements about your driving history. Otherwise, you may face consequences that were avoidable during a claim.

- We then receive your information

At this stage we have your information and your file is allocated a quote number which is immediately emailed to you. We’ll then personally review your application and prepare your insurance options.

If your application is received within business hours, we normally email your options back to you within 30 minutes. To view your options, click on the link in our email. Next, choose your preference along with any policy add-ons, then choose your policy start date (from the current day to 30-days in the future), choose monthly or annual payments and make payment. Presto, you’re insured.

Insurance is based on good faith. Which is why it’s important to be honest about your history, so that there are no dramas if you make a claim. We’re all about starting and maintaining good relationships. Why? Because trust and honesty are the foundation of lasting relationships.